Jeff Chang is a growth advisor and prolific angel investor, previously leading growth engineering teams at Pinterest for half a decade. We sat down with Jeff to dive deep on tactical ways to debug customer churn, the value of retention data, and user acquisition playbooks for early-stage companies.

Jeff Chang has been a growth advisor to a range of category-defining startups like Canva, Lyft, and Upwork. He's also a prolific angel, with investments in over 20 seed-stage startups.

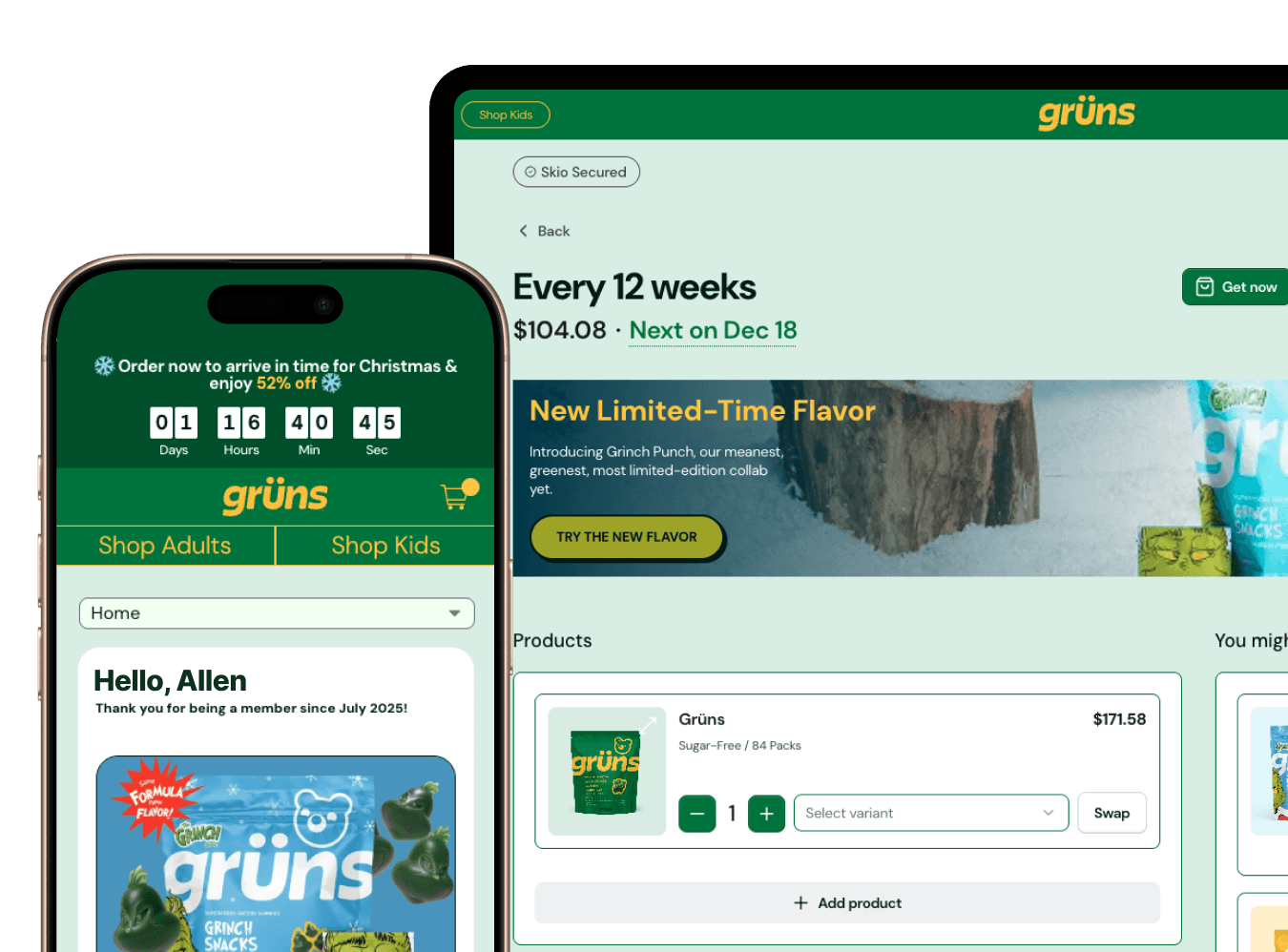

Previously, Jeff led various growth engineering teams at Pinterest for half a decade, scaling various teams from zero to one and the brand's MAU to 400M+. Jeff sat down with the team at Skio to run through customer churn troubleshooting, data-driven segmentation strategies, balancing paid versus organic playbooks, and acquisition blueprint breakdowns.

"With most questions or challenges at a startup, you just need to collect as much data as possible. Once you're armed with that data, you can make moves."

Debugging Customer Churn

After tracking retention data across multiple cohorts, you might still be seeing user dropoff and churn for a number of reasons. Jeff runs through a few examples:

The product is great, but after one use, the customer has no need for it again

The product isn't great, so the customer has no interest in using it again

The customer completely forgets about the product after one use

The customer tried the product but doesn't know how to use it

With so many variable events that could be driving dropoff, Jeff recommends two styles of debugging to get to the source of the churn: bottoms-up and data-driven.

Bottoms-Up Debugging

The job of a founder isn't only to understand what makes users stay, but also to understand what makes users abandon your product entirely. To solve for both, Jeff recommends conducting classic bottoms-up research by talking directly to your customers.

In Jeff's experience, massive survey blasts requesting feedback are uneventful and tend to be a waste of everybody's time. Instead, try to target and reach out to specific users or usage cases that have resulted in churn. Even a simple async email response can be highly informative.

For instance, if a user responds by saying they had no need for the product after one use, you've already figured out a cause for dropoff, albeit in isolation. Or if another user says they couldn't figure out how to use the product, you can dive deeper into the issue to collect as much qualitative data as possible on what's not working or causing confusion for your users.

Data-Driven Debugging

To suss out the source of churn by leveraging data analysis, Jeff recommends that founders start by figuring out what percentage of first-time users are sticking around, and then digging into what the commonalities are among those retained customers.

In his words, if you can piece together a profile of one type of customer that simply loves your product, you should be doubling down and honing in on that specific type of buyer.

Otherwise, segmentation is essential for drilling down on retention data.

Take a look at when exactly it is that users drop off and don't return. If they sign up but never log back in, it's likely an issue with onboarding, or perhaps your value proposition is inadequate and needs improvement.

You can also take a look at segments by breaking down your consumer base into personas, i.e. small vs. midsize vs. large companies. According to Jeff, working your way through your user segments is crucial to deciding which are stickiest and thus most likely to keep coming back.

"Most founders like to focus on why customers stay rather than why they churn. However, you really need both sets of data to define who your ideal user is."

Distilling Acquisition Blueprints

It's a familiar concept, and Jeff swears by it: Every brand is different, and you should take your acquisition cues from heavy hitters and growing names in your sector.

For instance, companies in certain DTC verticals invest heavily in paid acquisition because it traditionally comprises a large portion of their growth, while often remaining quite scalable. Meanwhile, for sectors like B2B and SaaS, paid GTM strategies just don't convert as well.

As a result, he recommends leaning into direct sales and organic content marketing blueprints.

More broadly, Jeff drives home the points that paid is a prominent investment of capital and time, and attempting to take anything but an all-in approach will likely be a waste of resources. Instead, he advises zeroing in on your highest performing GTM channel as that route will likely end up contributing 50% or more of your total acquisition across both organic and paid.

Doubling down on this point, Jeff adds that almost every great founder he works with has their acquisition breakdown memorized because it essentially drives their entire growth strategy.

For example, if 60% of sales come from a single channel, it's time to keep doubling down investment in that channel to see where it maxes out. Meanwhile, if you're pouring resources into a channel that contributes 5% or less to sales, it's time to reallocate and focus elsewhere.

"When it comes to acquisition, there's not really a middle ground. For example, if the content is performing, I'd say double down and go all-in on that channel."

Paid vs. Organic Playbooks

To round out the conversation, we asked Jeff what his go-to strategies are for structuring paid versus organic acquisition strategies. Spoiler: There's not a one-size-fits-all approach.

Paid Acquisition

Jeff typically recommends that founders of consumer brands navigate the paid acquisition flywheel for themselves first, rather than outsourcing to an agency or freelancer.

In terms of comparable ad costs, agencies are expensive with no guarantee of success, while zero capital is wasted if a founder steers the process themselves. Put simply, a founder needs to deeply understand their customers and consistently sell to them, insights that often come fastest through repetition and iteration across paid marketing channels.

In addition, from an investor's lens, a founder's core ability to sell their product signals a high degree of competency needed to scale their growth function over time.

Organic Acquisition

When it comes to organic tactics like social media and SEO, Jeff points out that a channel that works phenomenally well for one brand is never guaranteed to give the same results to another.

Rather, he advises testing multiple organic channels in tandem and distilling quantitative results, whether that's influencer partnerships, UGC-fueled social content, or in-depth storytelling.

As it relates to content specifically, Jeff notes that to succeed in original writing you need to find a niche where your content doesn't already exist.

Churning out content that competitors have already written about will only lead to your brand getting quickly drowned out in the market. In Jeff's words, organic acquisition requires a similarly concentrated effort with rapid hit-or-miss experimentation. Once you've found an organic channel that converts, keep doubling down.

"With both paid and organic, there's no guaranteed channel that will consistently convert. So, you need to learn the process for yourself and get your hands dirty."